We were delighted to take part in the MIT Arab Alumni Annual Conference, on a panel entitled “Inequality and Social Justice in the time of Corona”.

Leave your comments and questions below!

We were delighted to take part in the MIT Arab Alumni Annual Conference, on a panel entitled “Inequality and Social Justice in the time of Corona”.

Leave your comments and questions below!

VERSION FRANCAISE SUIT – النسخة العربية تلي الإنجليزية

for any additional information, please reach out: contact@oxcon.co

RELEASE –

In light of the ongoing COVID-19 crisis, OXCON has joined forces with other organisations and thought leaders from across the continent to develop a briefing paper outlining priority interventions for African governments.

The brief, which is available for download in English, French and Arabic, focuses on four main themes:

The report also highlights a number of international best practices, many of them in Africa, that could serve as a starting point for governments across the continents.

النسخة العربية

في ضوء أزمة فيروس كورونا، انضمت أوكسكون إلى مجموعة من المنظمات وقادة الفكر من جميع أنحاء القارة لتطوير ورقة موجزة تحدد أولويات العمل للحكومات الأفريقية.

و تركز هذة الورقة البحثية، و هي متاحة باللغات الإنجليزية والفرنسية والعربية ، على أربعة محاور رئيسية:

كما يسلط البحث الضوء على عدد من الممارسات الدولية المتميزة، والعديد منها في أفريقيا، والتي يمكن أن تمثل نقطة انطلاق للحكومات في تخطيطها لمواجهة الأزمة.

Version française

À la lumière de la crise COVID-19, OXCON s’est associé à d’autres organisations et leaders d’opinion pour élaborer une note d’information, décrivant les interventions prioritaires pour les gouvernements africains.

Ce document, disponible en anglais, français et arabe, se concentre sur quatre domaines d’intervention:

Le rapport met également en évidence des meilleures pratiques internationales, dont plusieurs en Afrique, qui pourraient servir de point de départ pour les gouvernements du continent africain.

[Originally published in African Business Magazine.]

How can fragile and conflict-affected countries in Africa embrace the benefits of the fourth industrial revolution and avoid its downsides? Mohamed El Dahshan considers two cardinal rules that policymakers should be sure to follow.

————————————————–

Forget humanoid robots and gene editing for a second.

In many corners of the world, the promise held by the fourth industrial revolution (4IR) feels remote, ethereal; and nowhere is this truer than in fragile and conflict-affected states (FCAS). Not because the 4IR does not hold much promise for them; but because other priorities, such as peace-building and stabilisation, appear fundamentally more urgent and, erroneously, at odds with it. There is thus a pressing need to consider its impact, identifying how the 4IR can best serve fragile states, and likewise how to best address challenges in ways that would further their stability and support their country-specific priorities.

Yet existing research of the 4IR focuses largely on developed nations; when it tackles developing countries, research focuses on middle and upper-middle income nations. Fragile states, each with their unique mix of economic, security, and stability challenges, appear to be largely excluded from this analysis, either due to lack of data, or failure to understand the challenges that these countries face. Which makes analysing them even more crucial.

Fragility – including political, economic, environmental, security and societal fragility – is an African problem. The Fragile States Index lists 39 African countries among the planet’s 59 most fragile. For the World Bank, 19 out of 36 “fragile situations” are African.

Yet some of the risks and opportunities of the 4IR, listed by Klaus Schwab in his 2018 tome, Shaping the Future of the Fourth Industrial Revolution, will sound eerily familiar to policymakers in fragile contexts. These include, among others, the risk of exacerbating income and wealth inequality within countries; the need for fresh approaches and social protection systems to cope with labour market disruptions; (re)designing skills development and employment models to boost labour productivity and creativity; ensuring the 4IR does not harm society’s vulnerable groups, including women and minority communities and cultures; and ensuring individual freedoms are maintained through these cataclysmic changes.

It is thus entirely possible to consider policies that would allow those countries to take advantage of this global developmental movement – beyond the obvious benefits of better telecommunications infrastructure or more affordable access to technology.

There, are already bright spots, of course, and sectors where fragile nations have proven adept at adopting, implementing, and deploying cutting edge technologies; Rwanda’s use of drones for medical deliveries to rural hospitals and – perhaps more interestingly for our purposes here – the accompanying regulatory framework, come to mind.

But even when we laud local 4IR success stories, we need to understand how underlying fragility could affect the often fragile equilibrium of FCAS. Somalia, for instance, has one of the most dynamic mobile money ecosystems, with 155m transactions taking place every month. But the sector is precariously poorly regulated, owing to weak state capacity. Largely untaxed, it represents a missed revenue opportunity for the state.

Take automation, for instance – one of the most salient trends of today and tomorrow. Though promising productivity gains globally, developing countries with young populations will necessitate “additional productivity raising measures […] to sustain their economic development”, according to a McKinsey flagship report on automation.

Countries will no longer be able to rely on their low wages to be competitive or attract investment. But low-income countries, particularly those that have emerged from crises, specifically look upon such jobs as a means to (re)build a middle class, engine of growth and consumption. This will require specific interventions, mass-scale re-skilling programmes, and social policies to ensure no one is left behind.

On the other hand, some technologies seem to offer particularly well-suited solutions for fragile contexts. Suffering from a deficit of trust, they could benefit from the use of distributed ledgers (such as blockchain) to assist in tasks such as land titling. Kenya has already begun to implement this; other countries are likely to follow. Likewise, public ledgers are being used to track value chains, identifying the source of components and ensuring quality and origin; Ethiopia has recently begun to do that for its coffee bean production.

Concerns will remain, and we need to be collectively cognisant of new challenges that emerge. Rumours and misinformation, spreading like wildfire through messaging apps in the hands of not-yet-discerning users, can undermine elections and contribute to communitarian violence. Some countries have adopted “false news” laws but there is the risk these could be use to suppress freedom of speech and jail critics.

So how can policymakers in FCAS prepare for the 4IR? By observing a cardinal rule of policy in fragile contexts: developing the twin goals of readiness and resilience. For this, decision makers will need to acknowledge that changes are numerous, fast, and overwhelming. There will be little room for slow policymaking that fails to appreciate that technology will impact every field of life. To succeed, they will need to partner with other stakeholders and will need to display transparency, openness, and collaboration with their populations. And they will need to acknowledge that they do not have all the answers.

There is no room for shying away from embracing the fourth industrial revolution. But there is certainly potential to mould its components to meet the needs of our countries, escaping from fragility and onto a sustainable development path. Some of the toughest challenges, however, may not be what we expect. As former Liberian President Ellen Johnson Sirleaf commented on her 12 years in power, the places where she may have failed were “in dealing with the softer issues: values, attitudes, norms”. And these challenges will only be exacerbated by technology, especially for nations seeking to catch up.

Khaled se despierta temprano. La mayoría de las personas en el campo de refugiados de Polikastro en el norte de Grecia lo hacen, las tiendas se vuelven demasiado calurosas para dormir después del amanecer. Pero Khaled se levanta con un propósito: él tiene que ir a trabajar, una de las pocas personas en el campo […]

Polykastro, Greece Khaled wakes up early. Most people in the refugee camp in Polykastro, in northern Greece, do – the tents get too hot to sleep shortly after the sun rises. But Khaled wakes up with intent: he has to get to work, one of the rare people in the camp who do. He starts […]

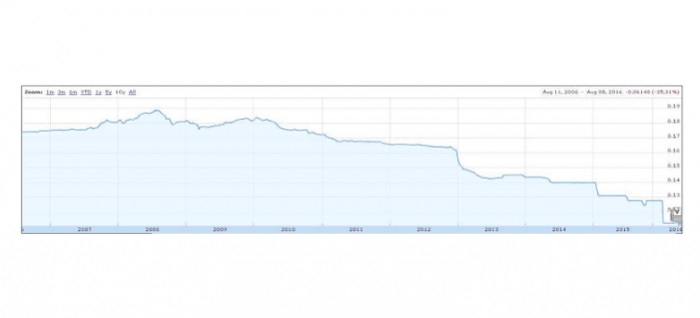

On Monday, July 25, the Egyptian pound (LE) reached its lowest value ever in the parallel market. The unofficial exchange rate, LE12.95 per U.S. dollar, was a staggering 47% below the government-set rate of LE8.88 to the dollar. The accelerating decline of the Egyptian economy has brought unprecedented public scrutiny of economic conditions, with citizens […]

After months of hints, predictions, and speculation, Egypt’s pound was floated on the market Thursday. Trading that morning at around 8.88 Egyptian pounds (LE) to the dollar, Egypt’s Commercial International Bank (CIB) closed the day at 16. Upon announcing the float, the Egyptian Central Bank set a target price ranging around LE 13 to the dollar, plus or minus 10, and though the rates at banks closed well outside this range on Thursday, the pound will continue to fluctuate as speculation lingers approaching the disbursal of a promised $12 billion loan from the International Monetary Fund.